Renters Insurance in and around Wichita

Looking for renters insurance in Wichita?

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

There’s No Place Like Home

Trying to sift through coverage options and savings options on top of your pickleball league, work and managing your side business, can be time consuming. But your belongings in your rented condo may need the remarkable coverage that State Farm provides. So when mishaps occur, your mementos, appliances and electronics have protection.

Looking for renters insurance in Wichita?

Rent wisely with insurance from State Farm

Protect Your Home Sweet Rental Home

Renters often raise the question: Is renters insurance really necessary? Just pause to consider what would happen if you had to replace your personal property, or even just a few of your high-value items. With a State Farm renters policy in your corner, you don't have to be afraid of unexpected mishaps. Renters insurance doesn't stop there! It extends beyond your rental space, covering personal items you've left in a storage closet, on your deck, or inside your car. Renters insurance can even cover your identity. As more of your life is online, it’s important to keep your personal information safe. That's where coverage from State Farm makes a difference. State Farm agent David Kemp can help you add identity theft coverage with monitoring alerts and providing support.

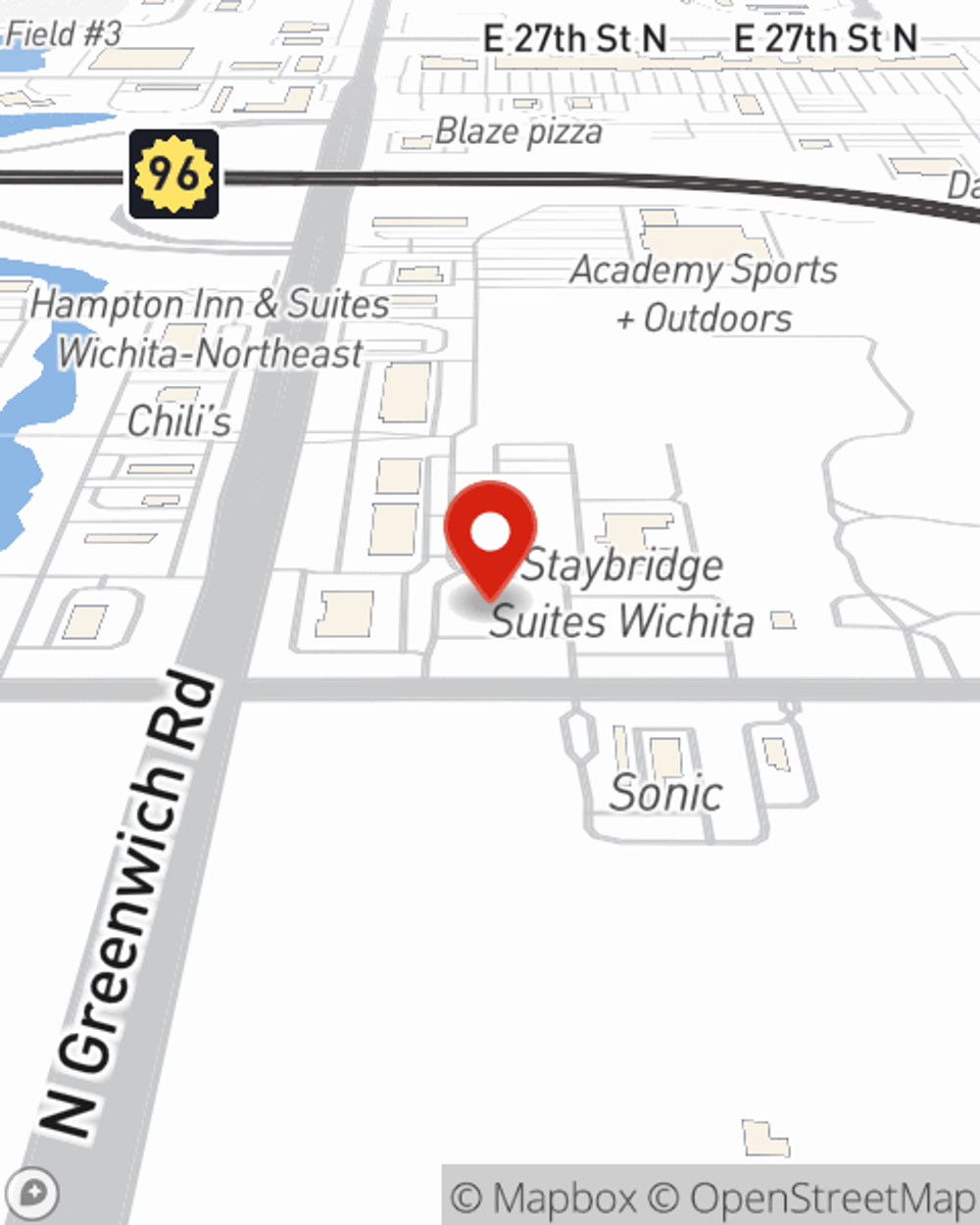

If you're looking for a value-driven provider that offers a free quote on a renters policy, call or email State Farm agent David Kemp today.

Have More Questions About Renters Insurance?

Call David at (316) 267-3846 or visit our FAQ page.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Simple Insights®

How to create a home inventory

How to create a home inventory

A home inventory can be a way to help make home or renters insurance coverage decisions & expedite the insurance claims process after theft, damage or loss.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.